Vie Variable Interest Entity China

Chinese Companies and the VIE Structure Foreword Over the last 18 years an increasing number of Chinese companies have listed on US. But a crackdown by Beijing on Chinas 100bn tutoring industry over the past week has included a ban on companies using this structure known as the variable interest entity VIE raising the.

We investigate Chinese firms use of variable interest entities VIEs to evade Chinese regulation on foreign ownership and list in the US.

Vie variable interest entity china. What you have are the American depositary receipts of a. Variable interest entities or VIEs that enabled many Chinese companies to raise money in the US. Variable Interest Entities are a legal quagmire for investors to grapple with if they want exposure to the fast-growing internet enabled businesses in China.

A VIE is an. Its very hard to model out such a risk in seemingly binary outcomes. Variable interest entities are used by businesses in sectors where China limits foreign ownership including telecommunications and education to let foreign investors buy in through shell.

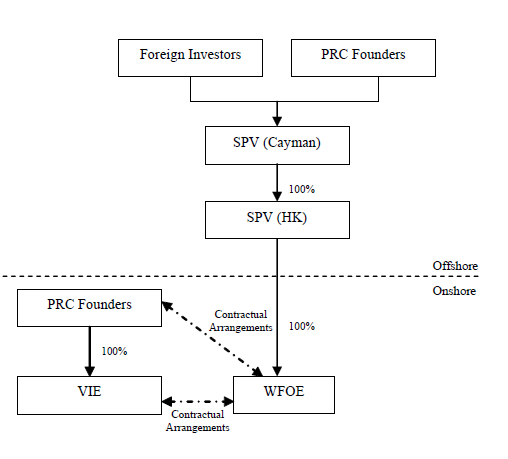

Variable Interest Entity VIE A Variable Interest Entity VIE is an entity based overseas but actually controlled by investors in the Chinese mainland and therefore it was not regulated. The note explains the history and origins of the structure the elements of the structure the key contracts that make up the structure and the key clauses required in. The use of the VIE structure is not only.

The variable interest entity VIE corporate structure. A VIE is a company that is included in consolidated financial statements because it. An overlooked consequence of the crackdown on antitrust business moves in China is that variable interest entities or VIEs have finally been folded into the legal system.

Variable Interest Entity Structure in China. Mark provides an ov. To non-accountants the VIE structure is a business structure that is widely used in certain business sectors in China that have.

Most investors prefer not to deal with regulatory risk. If you hold shares in New York-listed Alibaba Group Holding Ltd you dont own a stake in a Chinese internet powerhouse. Or it may refer to an.

WisdomTree launched its first ETFs in June of 2006 and is currently the industrys fifth largest ETF provider. Variable interest entities VIEs allow Chinese companies to list on foreign exchangesbut Chinas rules could be changing. To achieve the initial public offering IPO there are two options for Chinese companies onshore listing also known as A-share listing and offshore listing also known as.

This is no small matter as new rules define what business deals may look like in China in the future hampering the ultra-acquisitive strategies of the likes of Tencent and Alibaba. And so this is where the Variable Interest Entity VIE comes into play. Exchanges relying heavily on a corporate structure called a variable interest entity VIE.

We find that the use of VIEs for such ends is widespread growing and associated with valuation discounts of as much as 30 percent relative to Chinese non-VIE firms listed in the US. GUEST SERIES Variable Interest Entities in China 13 March 2019 Investors in Chinese companies soon encounter an obscure accounting term the variable interest entity or VIE. The structure is at odds with Chinese foreign investment.

Wall Street this week received a shock lesson in capitalism with Chinese characteristics as Beijings preferred market setup is often described. A note on the variable interest entity VIE structure that is commonly used for Chinese companies. We conduct what is to our knowledge the first systematic examination of Chinese-based firms that utilize a variable interest entity VIE structure to evade Chinese regulation on foreign ownership to list equity in the US.

The accounting definition of variable interest entity VIE is an entity in which an investor holds a controlling interest based on contractual arrangements and not based on owning the majority of voting rights. Are facing increasing scrutiny Alibaba is one of the many Chinese companies that used the VIE. The shares of many Chinese.

Assessing Variable Interest Entity Risk In Your China Portfolio. A variable interest entity VIE refers to a legal business structure in which an investor has a controlling interest despite not having a majority of voting rights. Dollars or the Chinese renminbi are better for these sensitive industries as of now the dollar prevails as the currency of choice.

While there is dissent in China regarding whether or not US. By Zeng Xianwu Bai Lihui King Woods Foreign Direct Investment FDI Group. Variable Interest Entities or VIEs is one option international tech companies have to enter China without relying on a Chinese partner.

The Vie Structure Past Present And Future Part I Hong Kong Lawyer

Alibaba S Simplified Vie Structure 51 Download Scientific Diagram

Variable Interest Entity Vie Structure For Foreign Investment In The Prc May Face Challenge China Law Insight

Vie Probably A Practical Option For Foreign Investors In Language Training Business Chinese Lawyer In Shanghai Shenzhen Guangzhou And Beijing

The Vie Structure Past Present And Future Part I Hong Kong Lawyer

Vie Like Structure Affirmed By Supreme People S Court In China

Posting Komentar untuk "Vie Variable Interest Entity China"