Variable Interest Entity (vie) Structure

Chinese Companies and the VIE Structure Foreword Over the last 18 years an increasing number of Chinese companies have listed on US. A variable interest entity VIE refers to a legal business structure in which an investor has a controlling interest despite not having a majority of voting rights.

Variable Interest Entity Vie Overview Advantages And Disadvantages

The variable interest entity VIE has long been a popular structure for foreign parties to invest in sectors which are restricted by Chinas industrial policy to foreign investment.

Variable interest entity (vie) structure. The note explains the history and origins of the structure the elements of the structure the key contracts that make up the structure and the key clauses required in. Inside Alibaba Group Holding Ltds filing on Tuesday for a US. Here we discuss the conceptual examples of the variable interest entity.

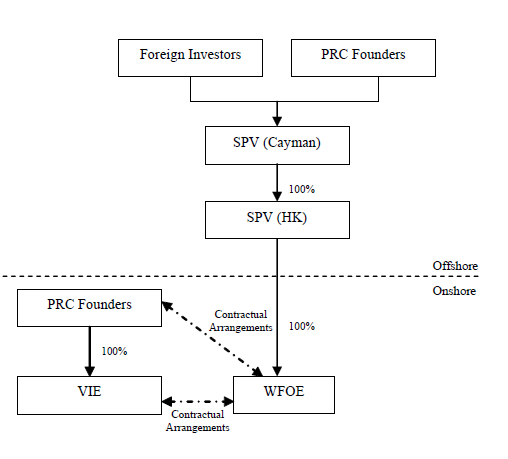

Variable Interest Entities are a legal quagmire for investors to grapple with if they want exposure to the fast-growing internet enabled businesses in China. By Zeng Xianwu Bai Lihui King Woods Foreign Direct Investment FDI Group. To achieve the initial public offering IPO there are two options for Chinese companies onshore listing also known as A-share listing and offshore listing also known as.

A VIE is an. The accounting definition of variable interest entity VIE is an entity in which an investor holds a controlling interest based on contractual arrangements and not based on owning the majority of voting rights. A poster of Chinese statesman Deng Xiaoping.

Initial public offering are three words well-known to China-focused investors but alien to many others. The Chinese national flag is seen in Beijing China April 29 2020. Variable Interest Entity VIE A Variable Interest Entity VIE is an entity based overseas but actually controlled by investors in the Chinese mainland and therefore it was not regulated.

Most investors prefer not to deal with regulatory risk. Its very hard to model out such a risk in seemingly binary outcomes. This posting will explain the use of variable interest entities VIEs by US.

How Chinese clampdown will target offshore listings. The variable interest entity VIE is a legal business structure that allows an investor to hold a controlling interest in the entity without that interest translating into possessing enough voting privileges to result in a majority. Guide to what is Variable Interest Entity VIE and its definition.

Wikipedia defines a VIE as an entity in which the investor holds a controlling interest that is not based on the majority of voting rights VIEs are similar to special purpose vehicles SPVs used to keep subprime mortgages of banks balance sheets. So is Hong Kong. Exchanges relying heavily on a corporate structure called a variable interest entity VIE.

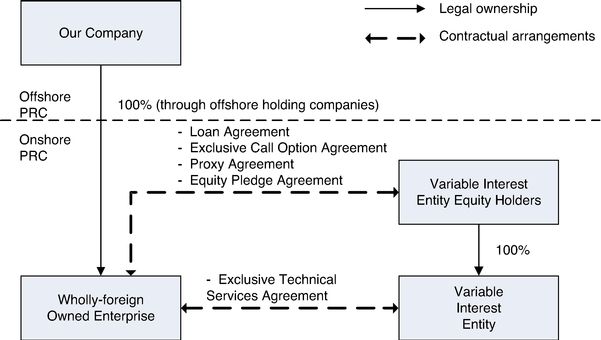

A note on the variable interest entity VIE structure that is commonly used for Chinese companies. HONG KONG July 8 Reuters - Chinas.

DANG which listed on the NYSE late in 2010 as an example of how the VIE structure is used. The structure is at odds with Chinese foreign investment. Answer 1 of 3.

The use of the VIE structure is not only. To non-accountants the VIE structure is a business structure that is widely used in certain business sectors in China that have. GUEST SERIES Variable Interest Entities in China 13 March 2019 Investors in Chinese companies soon encounter an obscure accounting term the variable interest entity or VIE.

Somewhat similar to the special purpose entity the variable interest entity. In this arrangement an Equity investment of 03 million is 100 outside of Enron and thus would make SPE independent of. A VIE is a company that is included in consolidated financial statements because it.

I have selected E-Commerce Dangdang Inc. Or it may refer to an. In addition the VIE structure has also been used as a means by which Chinese domestic entities could list offshore on international capital markets.

Before investing in Chinese companies it is critical to understand you are actually purchasing and the risks associated with this structure. The VIE structure that facilitates offshore listings in restricted sectors is one part of the one country two systems formula. We conduct what is to our knowledge the first systematic examination of Chinese-based firms that utilize a variable interest entity VIE structure to evade Chinese regulation on foreign ownership to list equity in the US.

Variable Interest Entity Structure in China. We take a look a.

Variable Interest Entity Vie Structure For Foreign Investment In The Prc May Face Challenge China Law Insight

Vie Probably A Practical Option For Foreign Investors In Language Training Business Chinese Lawyer In Shanghai Shenzhen Guangzhou And Beijing

Alibaba S Simplified Vie Structure 51 Download Scientific Diagram

The Vie Structure Past Present And Future Part I Hong Kong Lawyer

The Vie Structure Past Present And Future Part I Hong Kong Lawyer

Posting Komentar untuk "Variable Interest Entity (vie) Structure"