Variable Interest Entity China Explained

Variable interest entities VIEs allow Chinese companies to list on foreign exchangesbut Chinas rules could be changing. And Chinese Regulators Are in a Bind Over a Three-Letter Acronym Variable interest entities or VIEs that enabled many Chinese companies to raise money in the US.

Explaining Vie Structures China Accounting Blog Paul Gillis

The ADRs represent interest in a Variable Interest Entity VIE that has contracts with Alibaba not ownership interests of the company.

Variable interest entity china explained. I am writing about VIE structures now because according to a Pillsbury Client Alert Buddha Steel a Chinese company publicly traded in the United States revealed last week that the PRC government had disallowed its variable interest entity VIE structure. Variable Interest Entities in China 13 March 2019 Investors in Chinese companies soon encounter an obscure accounting term the variable interest entity or VIE. Variable Interest Entities in China A.

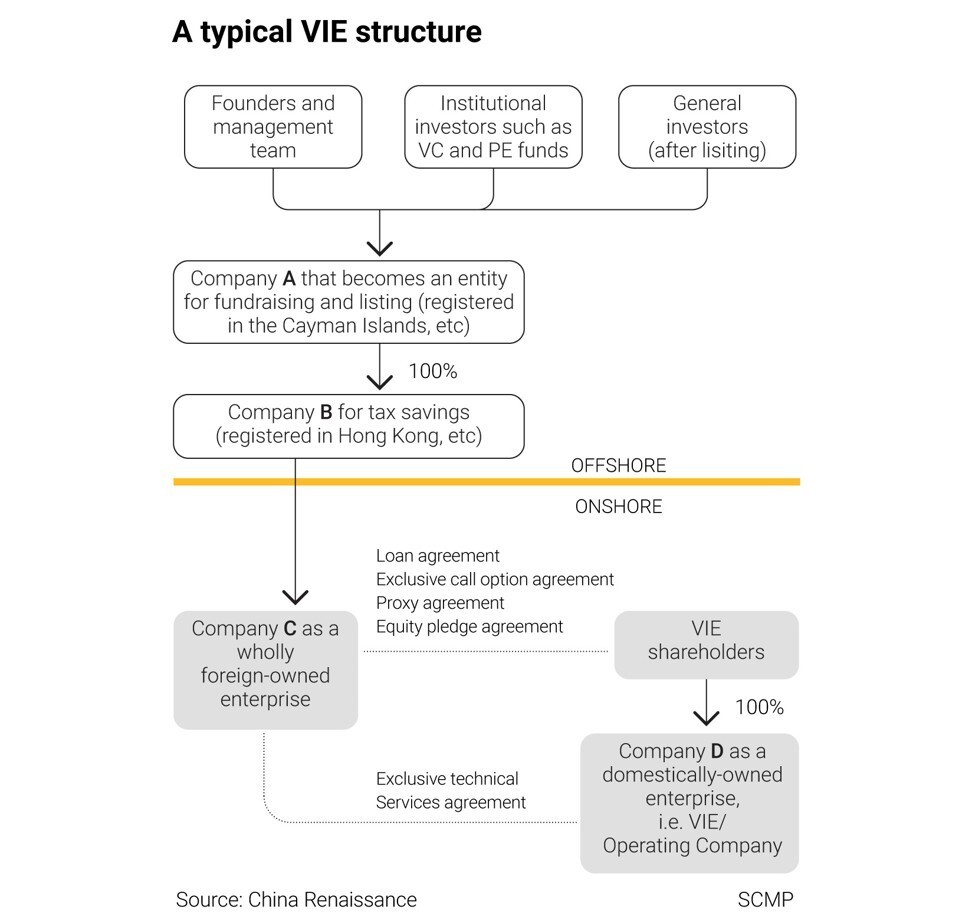

An ADR is a stock that trades in the US. The variable interest entity VIE has long been a popular structure for foreign parties to invest in sectors which are restricted by Chinas industrial policy to foreign investment. But represents a specified number of shares in a foreign corporation.

It concerns a China-specific oddity called the Variable Interest Entity structure. We find that the use of VIEs for such ends is widespread growing and associated with valuation discounts of as much as 30 percent relative to Chinese non-VIE firms listed in the US. A variable interest entity VIE is a legal entity in which an investor holds a controlling interest despite not having a majority of its share ownership.

Wall Street this week received a shock lesson in capitalism with Chinese characteristics as Beijings preferred market setup is often described. Most investors prefer not to deal with regulatory risk. In addition the VIE structure has also been used as a means by which Chinese domestic entities could list offshore on international capital markets.

We investigate Chinese firms use of variable interest entities VIEs to evade Chinese regulation on foreign ownership and list in the US. To non-accountants the VIE structure is a business structure that is widely used in certain business sectors in China that have. FIN 46R Consolidation of Variable Interest EntitiesAn Interpretation of ARB No.

Over the past 24 hours in a fund managers office somewhere some poor analyst has probably desperately typed variable interest entity China into Google in an attempt to figure out just. The structure is at odds with Chinese foreign investment. First a lesson on what is an ADR and VIE.

Exchanges relying heavily on a corporate structure called a variable interest entity VIE. The entitys equity is not sufficient to support its operations. Are facing increasing.

Explaining VIE structures in China This posting will explain the use of variable interest entities VIEs by US. History of Foreign Investments Restrictions Since 1949 the PRC has operated under the II Mao. DANG which listed on the NYSE late in 2010 as an example of how the.

The accounting definition of variable interest entity VIE is an entity in which an investor holds a controlling interest based on contractual arrangements and not based on owning the majority of voting rights. 51 was issued in December 2003 in response to accounting scandals in which certain types of variable interest entities VIE were used to structure transactions that excluded assets and liabilities from audited consolidated financial statements. A VIE is a company that is included in consolidated financial statements because it is controlled.

The Pillsbury Alert states that it is not clear whether this Chinese. A trader works during the IPO for Chinese ride-hailing. A VIE is an.

A VIE has the following characteristics. I have selected E-Commerce Dangdang Inc. Chinese Companies and the VIE Structure Foreword Over the last 18 years an increasing number of Chinese companies have listed on US.

Its very hard to model out such a risk in seemingly binary outcomes. Variable Interest Entities are a legal quagmire for investors to grapple with if they want exposure to the fast-growing internet enabled businesses in China. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features.

Residual equity holders do not control the VIE. 2016 CHINAS VARIABLE INTEREST ENTITY PROBLEM 543 saw the value of their shares plummet when it came to light that the companys Chinese VIE had issued a 164 million bond off the books and engaged in fraudulent retail practices19 In both the. The shares of many Chinese.

Alibabas Regulatory Work-Around to Chinas Foreign Investment Restrictions Kaitlyn Johnson.

China S Variable Interest Entity Structure Explained Suede Investing

Foreign Investment Law Series 05 The Vie Structure Remains In Grey Area China Justice Observer

China S Variable Interest Entity Structure Explained Suede Investing

Variable Interest Entities Youtube

Fasb Variable Interest Entities And Private Companies Youtube

Variable Interest Entity Vie Structure For Foreign Investment In The Prc May Face Challenge China Law Insight

Legally Ambiguous Vie Structure Means Foreign Investors Don T Technically Own Overseas Listed Chinese Stocks And That Could Spell Disaster South China Morning Post

Posting Komentar untuk "Variable Interest Entity China Explained"